India’s prominent audio and wearable brand, boAt, indicates that it is not in a hurry to get publicly listed. In a recent interview, Aman Gupta, boAt co-founder, confirmed that the company will likely launch its IPO in FY25-26. With this announcement, it is clear that boAt has no plan to bring its IPO next year.

Investors looking to invest in boAt IPO shares have to wait more or plan their investment in the company’s unlisted shares available in the grey market. You might wonder why boAt decided not to launch its IPO in 2023? In addition, what could be the possible effects of the boAt IPO delay on its unlisted shares? In the blog, we will answer all your questions and share the prominent reasons behind this boAt’s decision.

Why boAt Decide To Postpone Its IPO Plans Till FY25-26?

The news of the delay in the boAt IPO shocks the financial world as investors plan to invest in the most anticipated IPO shares of the company. There are various reasons behind this decision, which the boAt’s co-founder, Aman Gupta, shared in a recent interview. He clarified that boAt is well-capitalised and not ready to be listed publicly. The statement released from the PTI mentions that Aman confirmed that boAt is looking for a timeframe of FY25-26 for its IPO.

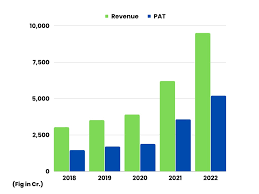

Since the company has performed well in the last few years, which is also reflected in boAt share price, there is no lack of capital, allowing boAt to postpone its IPO plans for 2023. From the financial point of view, the last fiscal year remained profitable for the company. boAt recorded a positive EBITDA, operational revenue, and profit in the last fiscal year. Apart from this, boAt share price in the grey market increased consistently in the last few months, reflecting the company’s stellar performance.

Another reason behind the boAt’s decision to delay its IPO plan is not to give its investors an exit. If a company decides to launch its IPO in 2023, there are probably higher chances that its early investors need to exit. boAt is more focused on its business growth now; it will continue to rely on its existing and new investors for funding rather than going public in a hurry.

How The Change In IPO Plans Will Impact boAt Unlisted Shares?

Investors interested in the IPO of boAt might have to wait longer and keep track of the performance of its unlisted shares in the grey market. boAt is working towards its business expansion plans and targeting new market segments. Here are the possible effects of the boAt delayed IPO plan on its unlisted shares:

High Demand For Its Unlisted Shares

There is an availability of boAt unlisted shares in the grey market for retail investors, which can be traded via online unlisted shares trading platforms like Stockify. As most investors wait for boAt IPO to plan their future investments, a delay in IPO may increase the demand for boAt unlisted shares.

As buying unlisted shares of the company gives investors early access to IPO stocks, there is a high probability that the majority of investors are looking to invest in boAt pre-IPO stocks.

Increase In boAt Share Price

The company postponed its IPO plan due to the business growth, which is reflected in boAt share price, which has consistently increased in the last few years. One of the major reasons behind it is the positive growth rate of boAt due to its expansion plan and target on the wearable segment.

In the future, we can expect that boAt will continuously work towards its business growth plan, which will positively impact boAt share price in the grey market so that investors can expect a high share price value for their investment in the coming months.

Limited Availability Of Shares

boAt has emerged as one of the profitable startups run by the marketing genius like Aman Gupta. Undoubtedly, the demand for boAt products will increase in the coming years, impacting the availability of boAt unlisted shares in the grey market.

There are chances that the availability of its pre-IPO shares will remain limited in the coming months. That is why buying unlisted boAt shares at the earliest is recommended to ensure availability.

Is It The Right Time To Invest In boAt Unlisted Shares?

As per the market data and expert predictions, it is the right time to invest in boAt pre-IPO shares. However, you should consider various factors like the company’s past and current performance, profit, growth rate, and most importantly, boAt share price.

If researching all this is daunting, you can use online trading platforms like Stockify.

You can access updated boAt share price and financials for the different fiscal years on this unlisted shares trading platform. You can also get assistance from expert brokers who will guide you throughout the trading process. Invest in boAt pre-IPO stocks to reap long-term benefits.