In the last few years, everyone has been captivated by the stock market as it is an efficient way of investing and earning high returns. The stock market is a popular financial marketplace where you can buy or sell the shares of publicly listed companies. Indian stock market, or Dalal Street, is the whole market that deals with securities, stock exchanges, and publicly traded businesses listed for sale. However, the share market is highly volatile, and the share prices keep fluctuating; hence you need good share market knowledge before beginning your investment journey. Also, to start with the investments, you need a stock trading account (DEMAT) and share details of the company that has the potential to offer high returns. This article will explain why NSE unlisted shares are worth investing in.

What Is NSE?

NSE, abbreviated as the National Stock Exchange of India Limited, is India’s most prominent financial marketplace. Established in 1992, NSE is the fourth largest stock market by the number of trades, and it offers a modern, digital trading platform for all investors in the country. Presently, it carries out all the wholesale debt, stock, and derivative markets transactions. India’s leading stock exchange plans for an IPO and will go public in the coming months. As the IPO news was out, NSE unlisted share price surged by 7% in the grey market. It is one of the best companies to invest in if you are interested in investing in the grey market. However, it is not the first time NSE share price has risen; its share prices keep surging with the changing market.

Reasons To Invest In NSE Unlisted Shares

NSE is a leading stock marketplace in India, and investing in the NSE unlisted shares has numerous benefits. Some of the reasons why NSE India stocks are worth investing –

Exponential Growth

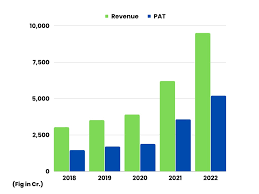

In the last three years, the revenue of the NSE has surged exponentially. The company’s net income was Rs 3,996 crore in FY20; in FY22, it surged to Rs 9500 crore. Furthermore, the company’s earnings before interest, taxes, depreciation, and amortisation (EBITDA) was Rs 2,655 crore in FY20; in FY22, it surged to Rs 7069 crore. In the same period, the EPS surged thrice, from Rs 38 in FY20 to Rs 104.95 in FY22. All the detailed financials are listed in the table below.

| Year | Revenue | EBITDA | OPM | PAT | NPM | Shares | Face value | EPS |

| 2015 | 2,275 | 1,710 | 75% | 1,026 | 45% | 4.50 | 10 | 228 |

| 2016 | 2,353 | 1,731 | 74% | 654 | 28% | 4.50 | 10 | 145 |

| 2017 | 2,680 | 1,915 | 71% | 1,218 | 45% | 49.50 | 1 | 24 |

| 2018 | 3,032 | 2,200 | 73% | 1,461 | 48% | 49.50 | 1 | 29 |

| 2019 | 3,514 | 2,441 | 69% | 1,708 | 49% | 49.50 | 1 | 34 |

| 2020 | 3,896 | 2,655 | 68% | 1885 | 48% | 49.50 | 1 | 38 |

| 2021 | 6,202 | 4,718 | 76% | 3,573 | 58% | 49.50 | 1 | 72 |

| 2022 | 9,500 | 7,069 | 74% | 5,198 | 55% | 49.50 | 1 | 104.95 |

| 2023 | 11586 | 9631 | 81.23% | 7356 | 57% | 49.50 | 1 | 148 |

High Trading Volume And Liquidity

The NSE’s liquidity is higher than BSE, which means purchasing and offloading the shares via NSE is easier than BSE. Moreover, there are better opportunities to convert your stocks directly into money. The number of traders on the NSE is way more than BSE, which means more buyers and sellers on the NSE. with a competitive advantage. The increased volume of traders on NSE attracts other potential investors, increasing the business of NSE. Currently, NSE holds a 90% market share in cash market volume and 100% in the F&O (Futures and Options) market volume.

Robust Technology

NSE offers a high-tech digital trading platform that allows a short settlement cycle and book-entry settlement. The NSE stays transparent throughout the investment process using the online trading portal and ensures the transaction is secure. Implementation of robust technologies and advancements in the system makes it stand out from its rivals and gain investors’ trust. The Indian financial marketplace also sells reliable trading technologies in other Asian countries.

Should You Invest In NSE Unlisted Shares?

Being the largest stock exchange in the country, it ranks 12th in the world, and NSE’s revenue is continuously surging. As the financial marketplace is gearing up for an IPO, the value of its unlisted shares is surging and expected to rise. More and more investors are buying NSE unlisted shares as they have the potential to offer you high returns that you might not get from other stocks. To sell or buy unlisted shares of NSE India or any other top-performing company, you can count on Stockify. It is India’s leading online broking platform where you can purchase unlisted shares of top-performing companies and know their current unlisted share prices, EBITDA, market valuation, equity per ratio, and more. Connect with the expert brokers at Stockify to kickstart your investment journey.